The Federal Reserve is set to lower interest rates, a decision that could have significant market impact depending on the size of the cut. Here’s everything you need to know about the Fed’s rate decision, current market expectations, and how it may affect consumer mortgage rates.

Expected Rate Cut from the Fed

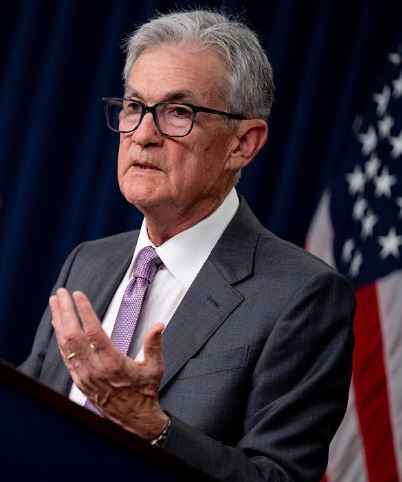

The Federal Reserve is widely expected to cut interest rates from the current range of 5.25% to 5.50%. There is ongoing debate about whether the cut will be by 0.25% or 0.50%. The official rate decision will be announced at 2 p.m. ET on Wednesday, followed by a press conference with Fed Chair Jerome Powell at 2:30 p.m. ET.

Key Points:

- The Fed will likely lower rates for the first time in over two years.

- The current target rate is 5.25% to 5.50%.

- Market reactions will depend on the size of the cut, with predictions split between a 25-basis-point or 50-basis-point reduction.

Impact on Consumer Rates

Higher interest rates have affected various types of loans and savings products. Here’s how things currently stand for consumers as they await the Fed’s decision:

Borrowing Rates:

- 30-Year Fixed Mortgage: As of Sept. 13, the average rate reached 6.12%, up from 4.29% in March 2022.

- Home Equity Loans: Rates have climbed to 8.49% from 5.96% in March 2022 (Source: Bankrate).

- Credit Card Rates: Interest rates on credit cards have increased by over 400 basis points since the Fed’s rate hikes, now sitting at 20.78% (Source: Bankrate).

Savings and Investments:

- Five-Year Certificate of Deposit (CD): The annual percentage yield (APY) for a 5-year CD has risen to 2.87%, up from 0.5% in March 2022 (Source: Haver).

- Money Market Funds: Yields have increased to 0.46%, compared to just 0.08% before the Fed began tightening rates (Source: Haver).

Market Uncertainty Around the Rate Cut

As the rate decision looms, investors remain divided over the extent of the cut. The CME FedWatch Tool indicates a 55% chance of a 50-basis-point cut, while a 25-basis-point reduction has a 45% probability.

What Experts Say:

Bank of America’s senior U.S. economist, Aditya Bhave, predicts a 25-basis-point cut, warning that a 50-basis-point reduction could signal deeper concerns within the Fed about the economy. According to Bhave, while a larger cut might temporarily boost risk assets, it could also suggest that the Fed is less confident about achieving a “soft landing” for the economy.

Key Takeaways:

- Investors are split on the size of the Fed’s rate cut.

- A larger cut might signal underlying economic worries rather than just monetary easing.

Fed’s Decision for mortgage

The Fed’s decision to cut rates will have widespread implications, from mortgage rates to investment yields. With uncertainty around the size of the cut, markets are on edge, and the post-decision reactions could depend heavily on how the Fed frames its outlook.

Sources:

- Bankrate (for mortgage, credit card, and home equity loan data)

- Haver (for savings and money market data)

- CME FedWatch Tool (for investor predictions)

Stay tuned for the Fed’s official announcement and further updates from the press conference.